We like some of our money to live in the cloud. Want to get started?

Part one is a recipe book for getting started.

Start Here: You need to decide your risk tolerance time to retirement etc. The “safer play” would be to Yield a stable coin and buy Bitcoin. However, some good timing can get you 100% or higher returns which is great. However, they could come and go overnight.

Get a Coinbase account then verify your identity and link your checking account. This is where we exchange Fiat or cash for crypto. Atom, Algo, Tezos all pay “staking” on Coinbase in the 4% to 6% range.

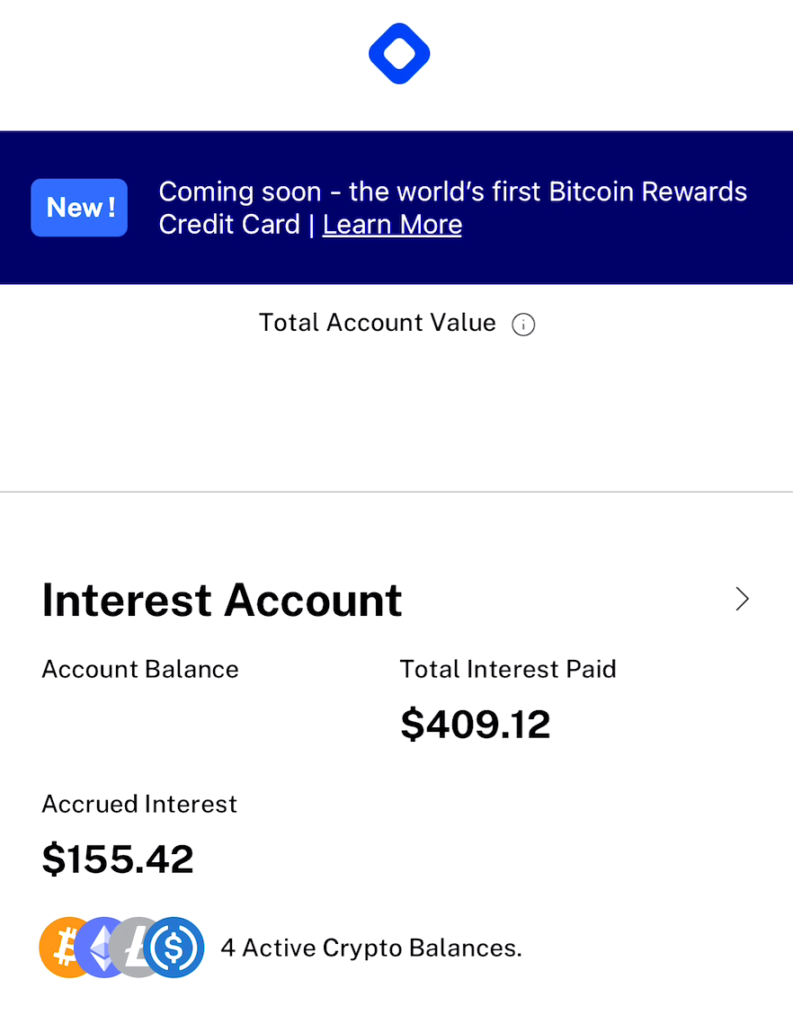

Get a Blockfi account to earn interest 8.6% on Stable Coins via Defi. You can get paid in USDC or BTC (and others) via Monthly distributions

Get a Celcius account and earn 13.9% in Matic or Synthetic (percentages change)

Get a CashApp and the “free debit card”. Apply boosts to get free cashback boosts or BTC on stuff you will already buy.

Crypto Definitions:

Crypto Currency: a digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank “decentralized cryptocurrencies such as bitcoin now provide an outlet for personal wealth that is beyond restriction and confiscation” · “as bitcoin gains ground, more companies have started accepting the cryptocurrency” – Wiki wiki wikapedia

Bitcoin: The first Crypto currency is now liken to digital gold. Traditionally highly volatile but historically goes up in value over time. Refer to Fibonacci. Rich folks and Traditional investors used to think it was a scam and they are gobbling it up now.

Alt Coin: All other coins after Bitcoin (BTC) are considered Alternate Coins. They are highly volatile but tend to do well historically as BTC climbs. Refer to Fibonacci. Each has a different purpose. Ethereum has a lot of tokens running on its platform.

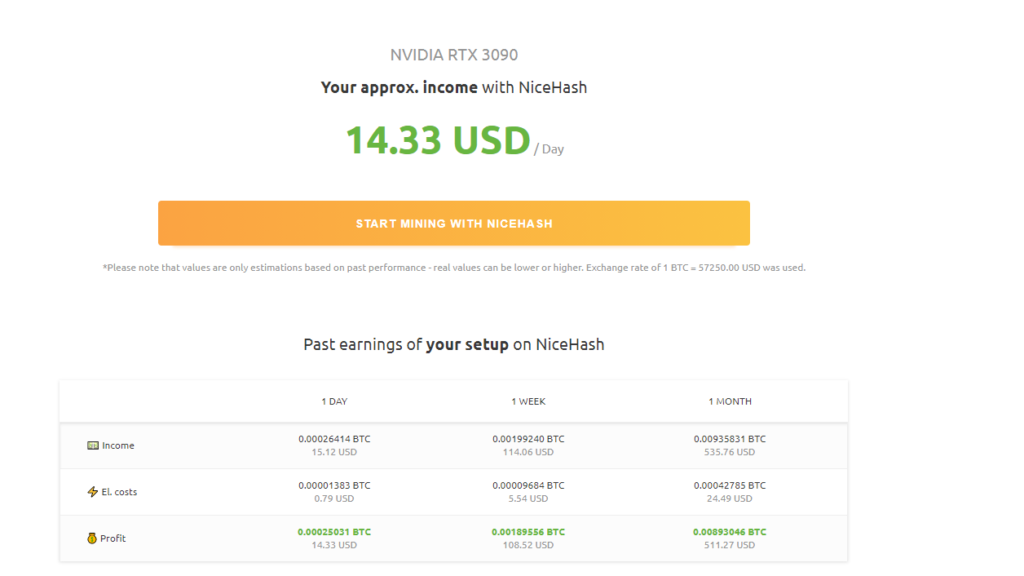

Proof Of Work: Get paid coins by Mining them. BTC, LTC, ETH ( Ethereum is converting to proof of stake).

Proof Of Stake: Get coins by Holding them or “Staking them”.

Stable Coin: These are coins coupled to the US Dollar and is considered “Stable”

Defi : Deregulated finance is when you loan proof of work coins like BTC, LTC, Matic, Synthetic and gain interest in that coin.

Yield Farming: Holding a proof of stake coin or proof of work coins to gain more coins. This can be via Defi or Staking.

FIAT: Fiat money is a government-issued currency that is not backed by a physical commodity, such as gold or silver, but rather by the government that issued it. The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government, rather than the worth of a commodity backing it as is the case for commodity money. Most modern paper currencies are fiat currencies, including the U.S. dollar, the euro, and other major global currencies. – investopedia

Fibonacci: Fibonacci was an Italian mathematician who came up with the Fibonacci numbers. They are extremely popular with technical analysts who trade the financial markets since they can be applied to any timeframe. The most common kinds of Fibonacci levels are retracement levels and extension levels. Fibonacci retracement levels indicate levels to which the price could retrace before resuming the trend. It’s a simple division of the vertical distance between a significant low and a significant high (or vice versa) into sections based on the key ratios of 23.6%, 38.2%, 50%, and 61.8%.

References:

Tesla CEO Elon Musk Calls Bitcoin (BTC) “Almost” As BS As Fiat Currency (coingape.com)

Fiat Money Definition (investopedia.com)

CNBC’s Mad Money Host Jim Cramer Sees Bitcoin As a Great Alternative To Gold (cryptopotato.com)

Mark Cuban: Bitcoin Is ‘A Store of Value’, $BTC and $ETH Will Survive and Thrive | Cryptoglobe